Bank Of Canada Tapering

The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether. The Bank of Canada cut its weekly net purchases of Canadian government bonds to a.

Bank Of Canada May Delay Quantitative Ease Taper Market Doubts Rate Hikes Rbc Better Dwelling

Having been the first major central bank to begin tapering earlier this year the BoC has lost the race to be the first to hike rates.

Bank of canada tapering. The BoC is likely to respond to the more positive macro outlook with the second tapering of its QE programme. The Bank of Canada which already holds over 40 of all outstanding Government of Canada GoC bonds compared to the Fed which holds less than 18 of all outstanding US Treasury securities announced today that it would reduce by one-quarter the amount of GoC bonds it adds to its pile from C4 billion per week currently to C3 billion. The Bank of Canada will announce its latest policy decision on Wednesday at 1400 GMT and is widely expected to move a step closer towards winding down its pandemic-era stimulus.

New Zealands central bank hiked interest rates on Wednesday for the first time in seven years becoming the second major developed. Holding its benchmark rate stead at 025 as expected the Bank of Canada continues to taper cutting weekly bond purchases to. Having been the first major central bank to begin tapering earlier this year the BoC has lost the race to be.

The Bank of Canada BoC garnered headlines by becoming the first major central bank this year to make reductions to its accommodative monetary policy. 2 days agoMore tapering on the way as markets ramp up rate hike bets In its last set of forecasts the Bank of Canada had predicted that its benchmark rate might need to be raised sometime in the second. Bank of Canada preview.

The recent spike in virus cases in Canada suggests it shouldn. It followed up with additional policy normalization moves in July and are now expected to taper again in October. The Bank of Canada will announce its latest policy decision on Wednesday at 1400 GMT and is widely expected to move a step closer towards winding down its pandemic-era stimulus.

Of the three monetary policy announcements this week the Bank of Canadas is the most important. In April the BoC became the first among Group of Seven central banks to. The Bank of Canada will taper its asset purchase programme again next quarter and raise interest rates earlier than previously predicted amid expectations for a robust economic recovery after a recent downturn a Reuters poll showed.

Overnight rates should. Canadian GDP down but not out 08312021. Bank of Canada to stay on tapering path but no new action this week Video ANALYSIS 692021 94614 AM GMT.

The Bank of Canada BoC was the first central bank. The Bank of Canada BoC is scheduled for a monetary policy meeting later at 2200 GMT8. It followed up with additional policy normalization moves in July and are now.

References Arias J Rubio-Ramirez J and Waggoner D 2018 Inference Based on Structural Vector Autoregressions Identified with Sign and Zero Restrictions. Bank of Canada to taper further as it holds rates steady. When the BOC meets on Wednesday theyll consider a delay in tapering At the last Bank of Canada meeting on July 14th the BOC tapered bond purchases from C3 billion per week to C2 billion per week because the financial institution felt the economy would still strengthen.

The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether. The Bank of Canada has released its first guidance on how it plans to reduce monetary stimulus saying it will first raise interest rates before reducing its government bond purchases. Bank of canada tapering.

1 day agoThe Bank of Canada is expected to announce a continuation of its asset tapering on Wednesday but its latest forward guidance will be key to the CAD reaction and its. The Bank of Canada will taper its asset purchase programme again next quarter and raise interest rates earlier than previously predicted amid expectations for a robust economic recovery after a. The Bank of Canada is expected to continue tapering its asset purchases and maintain its current rate posture when it concludes it meeting on Wednesday at 1000 am.

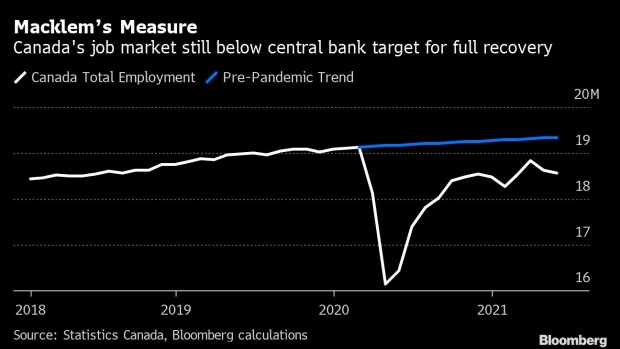

Bank of canada bond tapering. Despite the recent flareup in the pandemic the Bank of Canada pulled forward its estimation of when the economy will move back to pre-pandemic production to the second half of 2022. There is a strong expectation in the market that the central bank will be tapering its quantitative easing QE from the current C2 billion per week to C1 billion per week.

The Bank of Canada will announce its latest policy decision on Wednesday at 1400 GMT and is widely expected to take a step forward to lessen its stimulus. In addition the central bank is positioned to look through the coming increase in inflation which the bank estimates will move toward the top of its 1 to 3 range. Additionally although they slightly lowered their 2021 annual GDP to six they raised they 2022 forecast to 45.

Back in April the Bank of Canada set the ball rolling by becoming the first major central bank to cut bond purchases. 1 day agoThe Bank of Canada is expected to continue tapering its asset purchases and maintain its current rate posture when it concludes it meeting on Wednesday at 1000 am EDT. We expect weekly purchases to be cut from C4bn to C3bn in line with consensus.

Reuters Wednesday June 02 2021 1408.

Bank Of Canada Keeps Its Foot On The Gas But Hints At Changes To Come Financial Post

Bank Of Canada Now Owns 40 Of Government Of Canada Bonds Fed A Saint In Comparison Taper On The Table Wolf Street

The Taper Next Door Bank Of Canada Cuts Bond Purchases By 25 Total Assets Drop By 13 Rate Hikes Moved Forward Possibly July 2022 Wolf Street

The Taper Next Door Bank Of Canada Cuts Bond Purchases By 25 Total Assets Drop By 13 Rate Hikes Moved Forward Possibly July 2022 Wolf Street

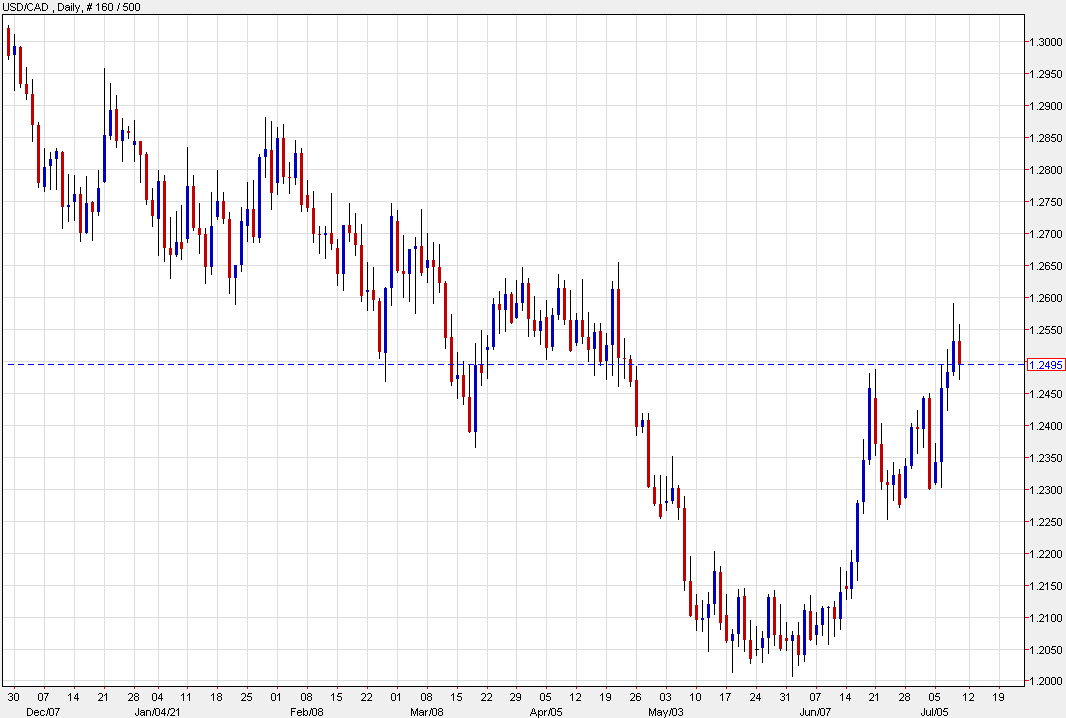

Boc Preview Ready To Continue Tapering But Does That Mean Usd Cad Will Move Lower

The Bank Of Canada Tapering In Focus Today 100fxb

Bank Of Canada Sits Tight But Expect More Tapering Menafn Com

Boc Taper Bet To Buoy Cad Against Yen Us Dollar And Euro Sydney News Today

Bank Of Canada Policy Decision Tapering Bond Purchases By 3 Billion A Week The Real Economy Blog

Bank Of England Now 2nd Central Bank To Taper After Canada But Denies Tapering Is Tapering Also Following Canada Wolf Street

Jobs Data Likely Seals The Case For Bank Of Canada Taper Next Week

Forex Preview 07 06 2021 Bank Of Canada To Stay On Tapering Path But No New Action This Week Youtube

Bank Of England Now 2nd Central Bank To Taper After Canada But Denies Tapering Is Tapering Also Following Canada Wolf Street

Investors See New Round Of Canada Bond Tapering Decision Guide Bloomberg

Investors Seek Clues On Bank Of Canada S Next Taper Decision Day Guide Bnn Bloomberg

Bank Of Canada Holds Steady Ahead Of Possible July Taper Bloomberg

Bank Of Canada Working Hard To Avoid A Taper Tantrum When It Eventually Slows Government Bond Purchases Financial Post

Week Ahead Tapering High On The Agenda As Ecb Boc And Rba Meet Investing Com

The Great Exit Central Banks Line Up To Taper Emergency Stimulus Reuters