Bank Of Canada Prime Rate

Not for US dollar loans in Canada. The rest of the bank herd then fell in line and matched.

Interest Rates Are Going To Go Crazy Soon

The Bank meets eight times a year.

Bank of canada prime rate. The Bank of Canada rate then dropped from 125 to 075 in 2015. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved reads the BoC statement released following its rate. If youd like to access the data for the charts you can download that here.

Low Inflation and COVID-19. This has a knock-on effect on mortgage rates which have risen roughly half a percent. The Prime rate is the interest rate that banks and lenders use to determine the interest rates for many types of loans and lines of credit.

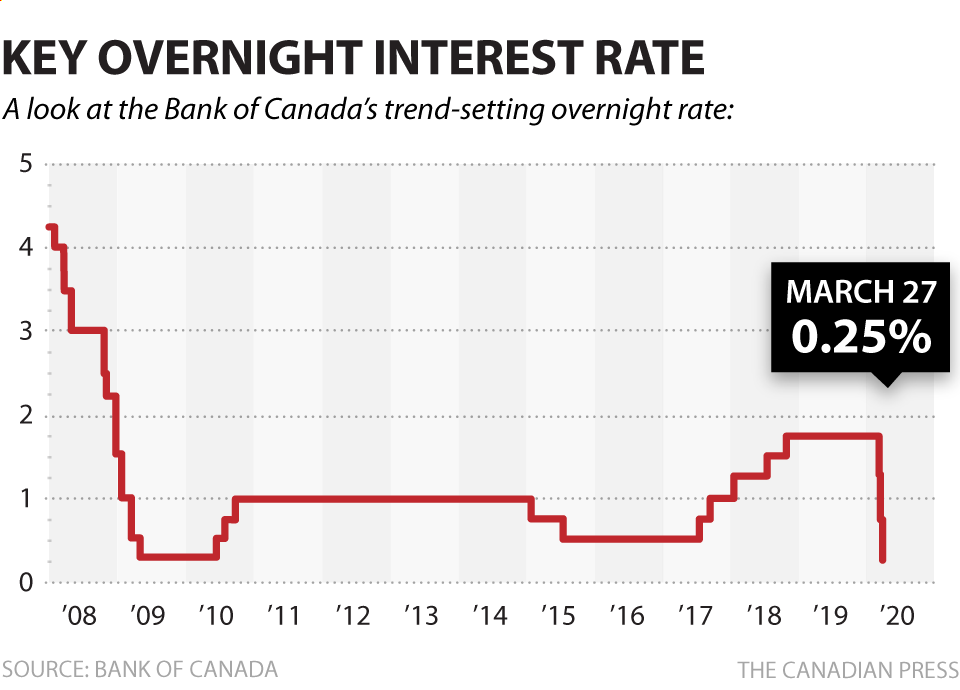

The prime interest rate fell from its previous level of 395 as the bank of Canada accelerated cuts to its overnight rate in order to boost the economy and minimize the financial impact of the pandemic. The Bank of Canada BoC opted to keep the overnight rate at 025 while also maintaining the quantitative easing QE program to at least 2 billion of asset purchases per week. Canadian Interest Rate Forecast to 2023.

Rates subject to change without notice. These can include credit cards HELOCs variable-rate mortgages car and auto loans and much more. Typical HELOC rates will drop to 395.

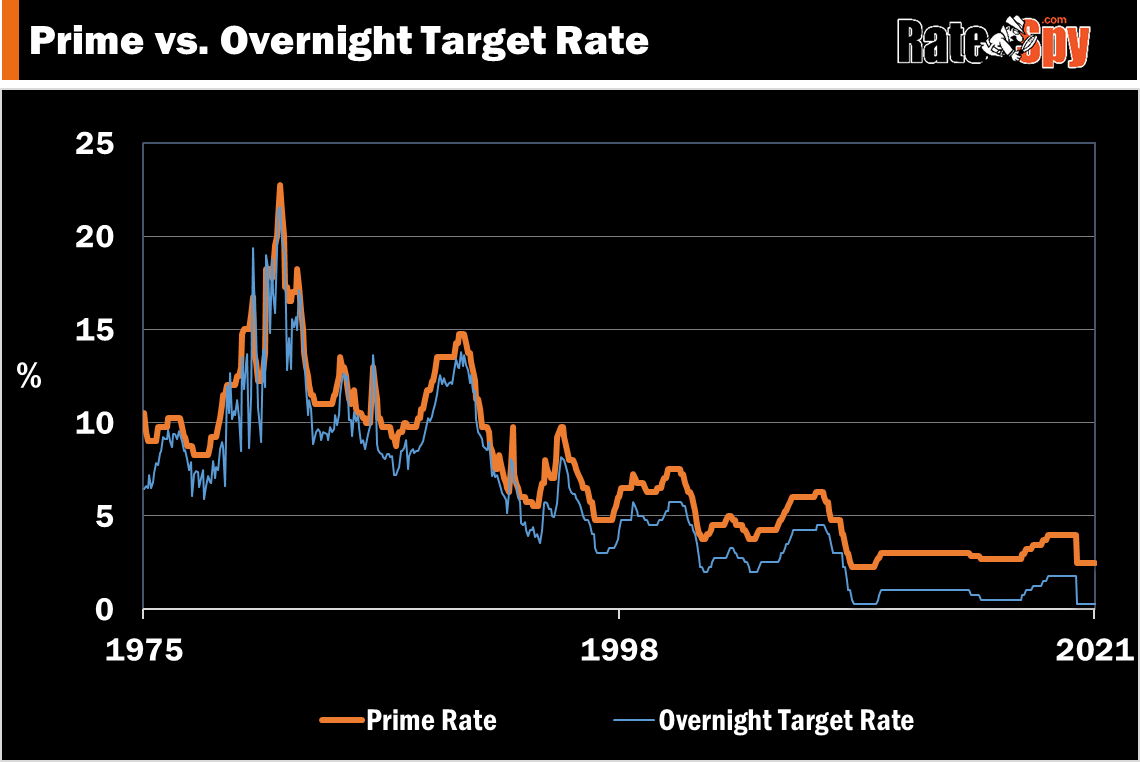

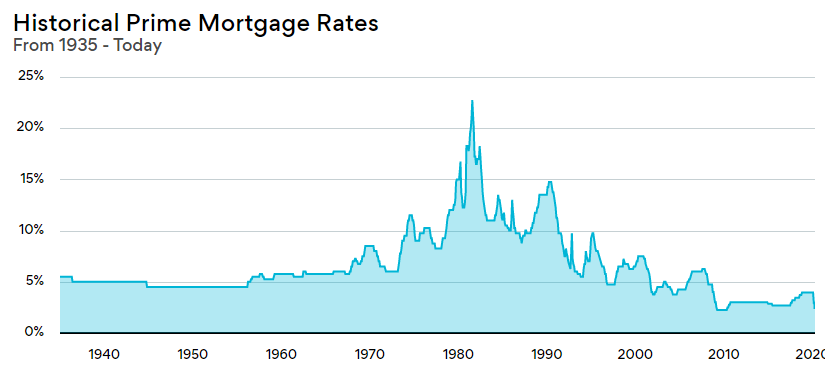

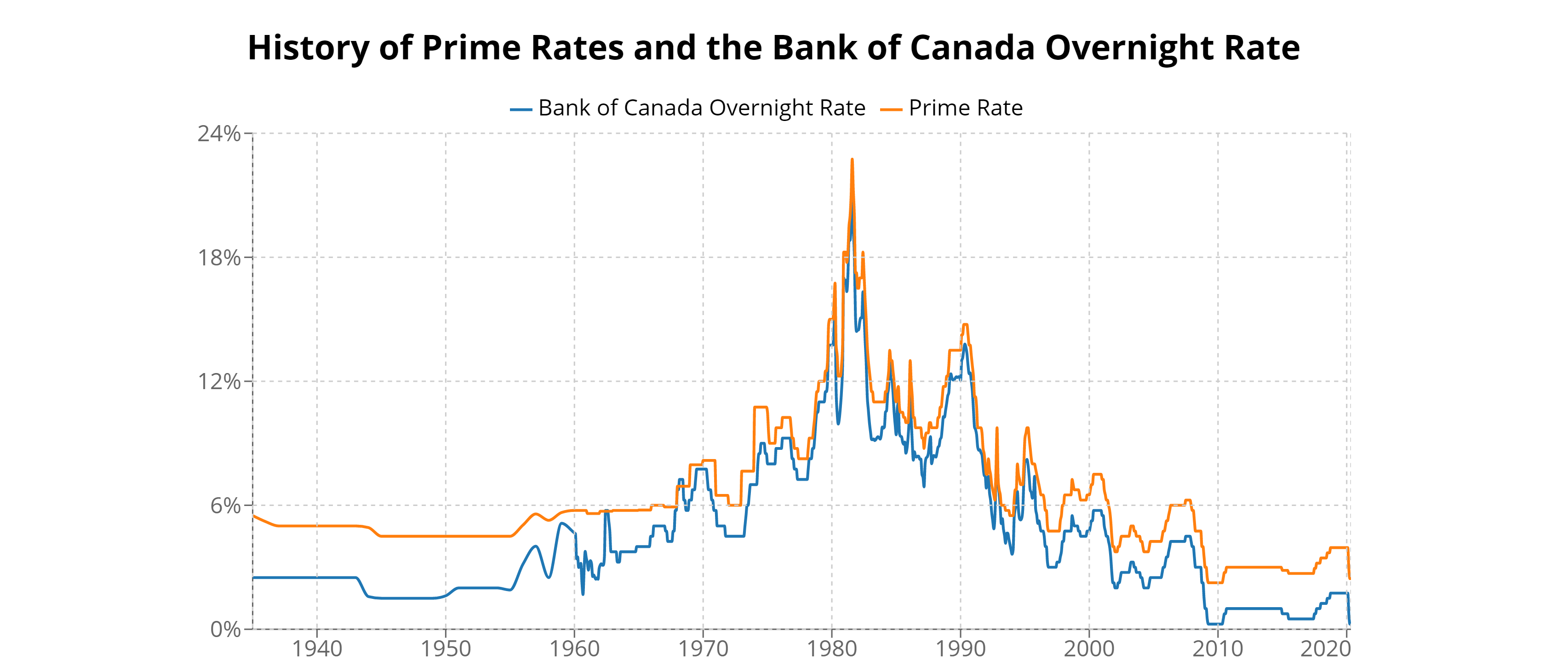

Annual interest rates on our Credit Card products. Bank Lending Rate in Canada averaged 711 percent from 1960 until 2021 reaching an all time high of 2275 percent in August of 1981 and a record low of 225 percent in April of 2009. CAD Deposit Reference rate.

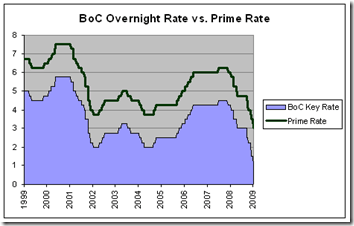

GICs and Term Deposits. Bank of Canada Interest Rates. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada.

Below is a graph of Canadas prime rate since the mid-1970s. The prime rate is set by Bank of America based on various factors including the banks costs and desired return general economic conditions and other factors and. All of Canadas main banks and financial institutions use the prime rate also called the prime lending rate as the annual interest rate.

Notes Interest rates are subject to change without notice at any time. The prime rate is driven by the overnight rate as set by the Bank of Canada. This rate influences the interest rates levied on variable loans variable rate mortgages and lines of credit.

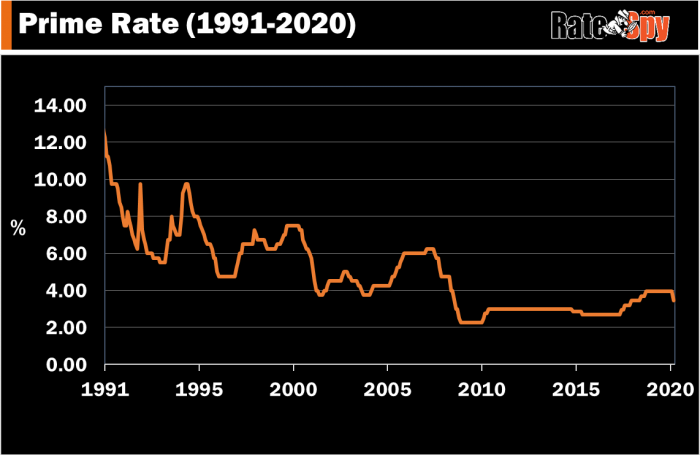

Prime almost always changes right after Bank of Canada rate announcements. Historically the prime rate in Canada has stayed below 12 since the creation of the Bank of Canada in 1935 except for a sharp jump in the 1980s due to widespread inflation a sharp increase in oil prices and a severe recession that pushed the interest rate to a peak of 21 for a sustained period of time. Canadian Prime Rate Chart.

60 chance of one hike in next 12 months BoCs Headline Quote. We are not a commercial bank and do not offer banking services to the public. Growth in the first quarter.

At its May announcement the Bank of Canada BoC signalled it might start raising short-term interest rates in late 2022 as a. Based on the Banks latest projection policy rate increases are now expected to happen sometime in the second half of 2022 BoC on the Economy. The prime rate has remained at 245 since it was cut three times in a row in early 2020 when the pandemic first hit Canada.

The all-time low was in April 2009 at 225 not far off from where we are now. Rates for residential mortgages. Only applicable to US commercial loans granted in the United States.

The US Prime Rate is equal to the US base rate - 050. The Bank of Canada is the nations central bank. See Prime Rate Market Rate Forecast.

This page provides - Canada Prime Lending Rate - actual values historical data. BoC emergency rate cut in 90 seconds The Bank of Canada has made a second unscheduled cut to its benchmark interest rate lowering it. Canada Prime Rate is at 245 compared to 245 last week and 245 last year.

The Bank of Canada keeps overnight rate at effective lower bound and maintains QE program. The prime rate underpins a slate of variable-rate loans including mortgages and thus impact the cost of borrowing for a range of financial products. The overnight rate is rate at which banks lend to each other.

The prime rate in Canada is currently 245. This is lower than the long term average of 785. Prime Rate Advertising Disclosure.

The current Bank of America NA. Bank of Canadas prime rate history. Long-term government bond rates have risen from 03 to 10 since January.

The Prime rate in Canada is currently 245. Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada. The Bank of Canada delivered welcome news for variable-rate mortgage holders today when it stood by its expectation of no rate hikes until early 2023.

The next Bank of Canada rate meeting is October 27 2021. Best Mortgage Rates in Canada. US Base Rate.

Assuming banks dont change their discounts thatll drive down the average conventional variable rate to roughly 250. Prime rate is 325 rate effective as of March 16 2020. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products.

The prime rate also known as the prime lending rate is the annual interest rate Canadas major banks and financial institutions use to set interest rates for variable loans and lines of credit including variable-rate mortgages. USD Deposit Reference rate. Despite widespread economic growth 2018 and 2019 were marked by continued low inflation preventing the Bank of Canada from raising rates any higher than 175.

The prime rates all-time high was in August 1981 at a whopping 2275. Effective tomorrow Canadas benchmark prime rate will drop to 345 a place it hasnt been since July 2018. Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management.

Oct 22 2021 0838 EDT. Most of the time the Bank does not change rates at its rate meetings. No change to rates Overnight rate.

Low Interest Rate Party May Be Ending The Star

Bank Of Canada Prime Rate History Sandra Jackson Real Estate Toronto

Posthaste Bank Of Canada Could Keep Interest Rates Super Low For Next 4 Years If These Economists Are Right Financial Post

Bank Of Canada Interest Rate History

Fichier History Of Prime Rates And The Bank Of Canada Target Overnight Rate Png Wikipedia

Bank Of Canada Raises Interest Rate To 1 75 Cbc News

Prime Rate Stays At 3 45 Bank Of Canada Ratespy Com

Canada S Big Banks Cut Prime Rate After Boc Move The Globe And Mail

Bank Of Canada Slashes Key Interest Rate To 0 25 National Globalnews Ca

Prime Vs The Bank Of Canada Mortgage Rates Mortgage Broker News In Canada

Canada S Prime Rate Drops To 3 45 Ratespy Com

Historical Relationship Bank Of Canada Bank Rate Vs Prime Rate Simple Financial Analysis

File History Of Prime Rates And The Bank Of Canada Target Overnight Rate Png Wikimedia Commons

Why The Bank Of Canada Could Be Among The First To Raise Interest Rates Financial Post